Content

- Can I Deduct Farm Equipment On My Taxes?

- Sample Full Depreciation Schedule

- Get Legal Help For Any Legal Need From People In Business

- How To Deduct A Charitable Contribution Of Depreciated Assets

- Our Top Accounting Software Partners

- How To Do A Prepaid Payment Transaction In Accounting

- How Can I Calculate The Value Of My Salvage Car?

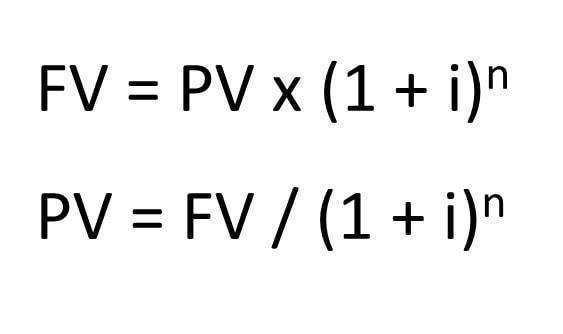

Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. The annuity method of depreciation, also known as the compound interest method, looks at an asset’s depreciation be determining its rate of return. Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

- You know you’ve correctly calculated annual straight-line depreciation when the asset’s ending value is the salvage value.

- It equals total depreciation ($45,000) divided by useful life , or $3,000 per year.

- At the end of the asset’s useful life, it will be fully depreciated.

- Different depreciation methods handle salvage value differently.

- You can use different methods to accelerate depreciation — that is, take larger deductions in the early years of ownership.

- Multiply the car’s current market value decided earlier by 0.25, meaning 1.00 minus 0.75, to find its salvage value.

What is considered residual value varies across industries, but the core meaning is nevertheless retained. Keep reading to know more about the meaning of residual value, its benefits and how to calculate it. Use this calculator to calculate the simple straight line depreciation of assets. Salvage value is most commonly determined in an insurance claim where there are damaged items. If you want to get the best salvage car quote, head to DamagedCars.com.

Can I Deduct Farm Equipment On My Taxes?

Once the company no longer uses the asset or the revenue generated from it has become rather unpredictable. The straight line calculation, as the name suggests, is a straight line drop in asset value. Gold works similarly, and there are calculators online which can help you determine both spot and scrap prices. Because most sellers of silver and gold do not have access to the commodities market. Even if the plate was damaged beyond that acceptable by most collectors, there might still be a market for the damaged plate.

This means that even if you have bought an asset second-hand, machinery or computer hardware, for example, your purchase price is the value at the time of acquisition of the asset. When setting up depreciation, this is the amount needed to begin applying the depreciation method. The Excel equivalent function for Straight-Line Method is SLN will calculate the depreciation expense for any period. For a more accelerated depreciation method see, for example, our Double Declining Balance Method Depreciation Calculator.

Sample Full Depreciation Schedule

Even if you go out of pocket for substantial repairs or insurance pays for them, you are still likely to receive about 70% of the value of a used car that was never damaged. It’s better to get help from people who specialize in appraising, buying, and selling less-than-perfect cars, which means they can often get you more for your old total loss vehicle than usual dealers. Salvage value We are entitled to any salvage value on recovered items and damaged items that have been replaced. In accounting, residual value is another name for salvage value, the remaining value of an asset after it has been fully depreciated, or after deteriorating beyond further use. You need to provide the three inputs of the original cost of the asset, depreciation rate, and the number of years. In cost accounting, the scrap value is the raw materials of the product that the manufacturer will sell off as scraps. Depreciation For This EquipmentDepreciation on Equipment refers to the decremented value of an equipment’s cost after deducting salvage value over the life of an equipment.

Is salvage value an inflow or outflow?

Initial cost and salvage value Any cash outflows necessary to acquire an asset and place it in a position and condition for its intended use are part of the initial cost of the asset. If an investment has a salvage value, that value is a cash inflow in the year of the asset’s disposal.

The third and the most common approach is to take the salvage to zero. In this approach, there is no chance of people tricking accounts. There have been several cases when people underestimate or overestimate salvage value to inflate or deflate their income and tax. Analysts and tax experts see this approach as more practical and conservative. After its useful life or after fifteen years, the vehicle should end up in a junkyard.

Get Legal Help For Any Legal Need From People In Business

After ten years, the company estimates its useful life of $2000. So, depreciation, in this case, will be (($20000 – $2000)/10) $1800 per year.

Salvage value is typically much lower than used car value based on a few factors, primarily the car has been repaired or not. That leaves you with local junkyards, who are notorious for the lowball offers, various scams, and intense pressure to sell on the spot. Junk Value is the amount that you might expect to realize if the depreciable asset is hauled away intact to junk dealer. The condition of the asset based upon maintenance and the amount of wear-and-tear accumulated during its Useful Life.

How To Deduct A Charitable Contribution Of Depreciated Assets

Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.

- This is often heavily negotiated because, in industries like manufacturing, the provenance of their assets comprise a major part of their company’s top-line worth.

- Jeffrey Joyner has had numerous articles published on the Internet covering a wide range of topics.

- Salvage value is the estimated resale price for an asset after its useful life is over.

- Say that a refrigerator’s useful life is seven years, and seven-year-old industrial refrigerators go for $1,000 on average.

- The straight line calculation, as the name suggests, is a straight line drop in asset value.

- There are two types of depreciation methods which are used in Finance.

And a car with a salvage title’s value is subject to the few willing to buy it, and what they will pay. The good news is that the salvage price of your car may be much higher than local scrap vehicle prices, or what an insurance adjuster values your totaled car at. You can find out how much your totaled car is worthnow, or read on to learn more about salvage value.

Our Top Accounting Software Partners

The salvage value is necessarily an estimate of an asset’s value after it has been used over a period of time. A common method of estimating an asset’s salvage value is to estimate how much the asset could be sold for. Its salvage value in this case would be based on its estimated market value after it had been in use for a certain length of time. Since different owners might estimate different market values for an asset, standard values that have achieved industry acceptance are often used for salvage values.

- It’s your choice whether to use salvage value or net salvage value — the property’s end value minus the cost of disposal.

- The cost to repair the bowl is more than the replacement value, and the insurer cashes out the client.

- She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting.

- For example, if you use the modified accelerated recovery system, or MACRS, as your depreciation method, you do not assign a residual value.

- Salvage value is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated.

- Perhaps the most common calculation of an asset’s salvage value is to assume there will be no salvage value.

Salvage value is the amount for which the asset can be sold at the end of its useful life. Determine the percentage used by the insurance company that deemed the vehicle a “salvage vehicle.” This is often 75 percent of the market value, but each insurance company determines the percentage it uses. While we might think about the metals being sold for scrap in this instance, the salvage value of the wine cooler or car also includes the parts that might be used to repair other appliances or cars. If a car is totaled and a bumper needs to be replaced (or a speaker system or a dashboard, etc.), then car repair shops will often source those parts from damaged vehicles. Or a dealer might buy a damaged painting and have it restored for resale. So, how should you try to determine the value of a totaled car?

How To Do A Prepaid Payment Transaction In Accounting

Therefore, the salvage value of the machinery after its effective life of usage is INR 350,000. Therefore, the salvage value of the machinery after its effective life of usage is INR 30,000. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

Depending on the factors involved, how much a salvage title reduces a car’s worth can be even more than that. Many dealers won’t buy rebuilt vehicles or those with salvage titles because of the unknown complications that may arise after purchasing. Talking of a real-world example, a company by the name Waste Management, Inc did several frauds between 1992 and 1997 by misusing salvage value.

How Can I Calculate The Value Of My Salvage Car?

Most likely, they would look at an auction or some other sort of secondary market dealing with damaged items. Salvage yard prices can vary from city to city and even yard to yard. So, it’s nearly impossible for you to get an accurate number for the value of your car. The best you can do is find the approximate value of your used car pre-accident using online pricing calculators.

Forest Service seeks public input on fire salvage – Bonner County Daily Bee

Forest Service seeks public input on fire salvage.

Posted: Fri, 26 Nov 2021 09:00:45 GMT [source]

You’re essentially buying your salvage car from the insurance company. Your company may purchase long-lived assets such as property, plant and equipment that you depreciate over their useful lives. Depreciation is how the Internal Revenue Service allows you to expense part of an asset’s cost over a number of years. Salvage value is an estimate of the residual amount you will receive when you dispose of the asset. Different depreciation methods handle salvage value differently.

What is difference between salvage value and scrap value?

Salvage value is the amount that an asset is worth at the time it is no longer useful or operational for your business after applying depreciation over its useful life. … Salvage value (also often referred to as ‘scrap value’ or ‘residual value’) is the value of an asset at the end of its useful life.

Reselling the asset is not required for depreciating it or calculating its salvage value for accounting purposes. Other popular depreciation methods include declining balance, double-declining balance, sum-of-years digits, and units of production. Regardless of the method you use for building your depreciation schedule, you will need to calculate salvage value. This depreciation method is the most common because of its simplicity. You calculate the depreciation value of an asset and expense it equally through the useful life of that asset until you reach its salvage value.

Gak ada cerita bilang ke China ini AP pokoke elu 49% gw (Pihak Indonesia 51%) sebagai modal eksistensi AP yg sdh ada. Kalau China nilai AP sdh salvage value (aka Junk sdh 10-15th) ga bisa pihak Indonesia memberi nilai kepemilikan 51% seenak beronya. Ini persisnya.

— Ronnie H. Rusli. MS. PhD. (@Ronnie_Rusli) November 26, 2021

The salvage value can be a best guess of the end value or can be determined by a regulatory body such as the IRS. To calculate scrap value, you need to take your spot value and multiply it by the middleman’s margin. However, a chipped 18th-century armorial Chinese export porcelain plate might still have some value depending upon the size of the chip and the willingness of the market to accept some damage. Most collectors of 18th-century Chinese export armorial porcelain will accept small chips or frits and/or a restored piece. Therefore, you go through the same steps that we did with the painting.

Here, we’ll calculate the residual value of a piece of manufacturing equipment. Take that the manufacturing equipment cost $40,000 and say the useful life is estimated at eight years. Let’s take $5,000 as the estimated salvage value of the equipment when it’s disposed of as scrap metal after its useful life. Residual value refers to the estimated worth of an asset after the asset has fully depreciated.

VinePair Podcast: Can Six Expulsions Salvage the Court of Master Sommeliers? – VinePair

VinePair Podcast: Can Six Expulsions Salvage the Court of Master Sommeliers?.

Posted: Tue, 30 Nov 2021 12:14:24 GMT [source]

Companies have several options for depreciating assets on their books, but the most popular is the straight-line depreciation method. When a company purchases an asset, first, it calculates the salvage value of the asset. Thereafter this value is deducted from the total cost of the assets, and then the depreciation is charged on the remaining amount.

Author: Mark Kennedy